TX TREC 30-11 2014-2024 free printable template

Show details

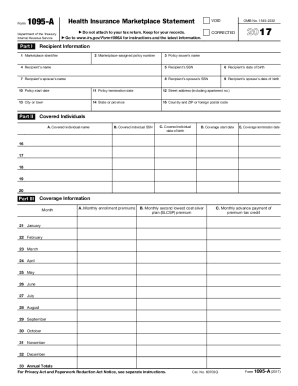

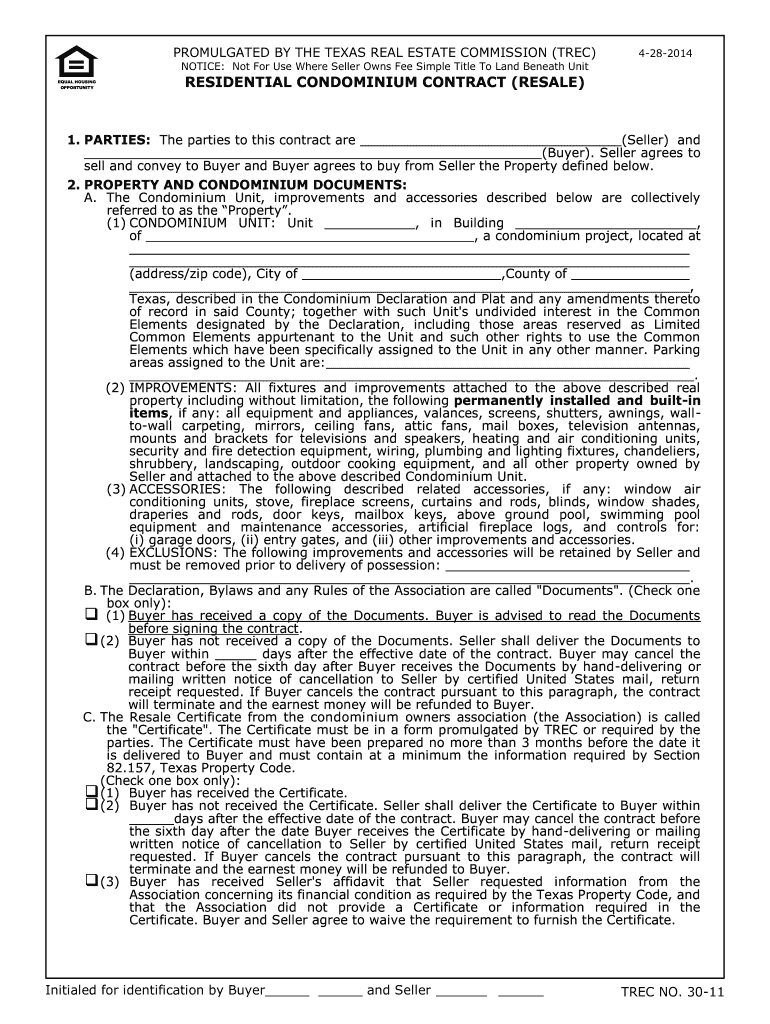

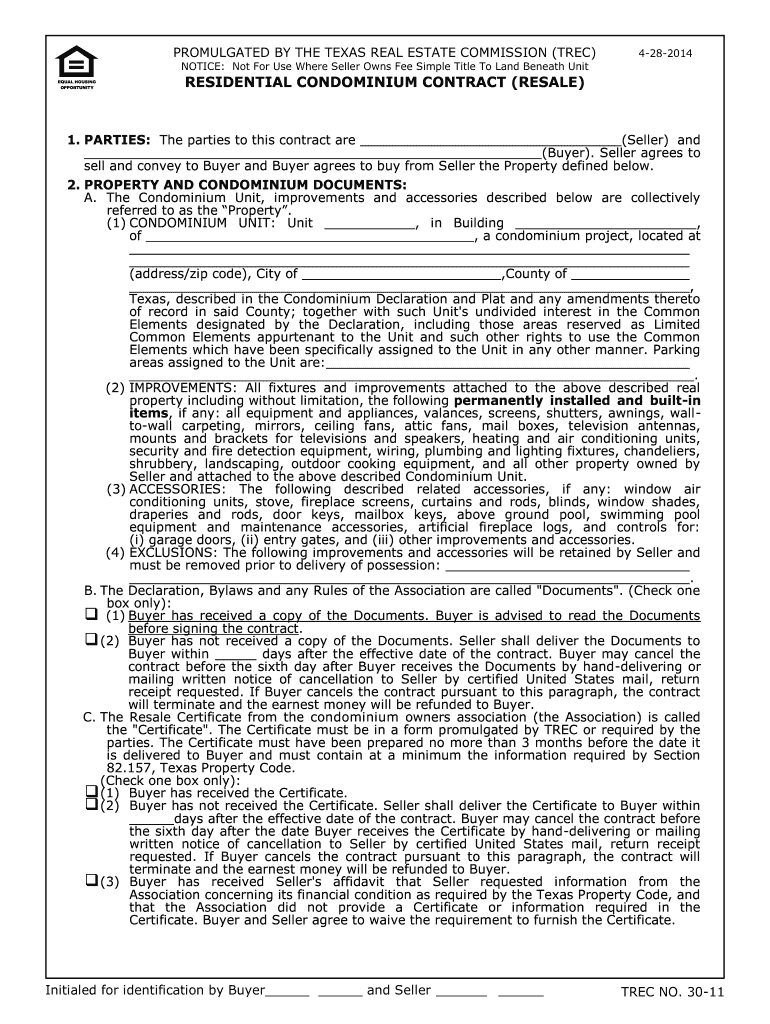

RESIDENTIAL SERVICE CONTRACTS Buyer may purchase a residential service contract from a residential service company licensed by TREC. Contract Concerning EQUAL HOUSING OPPORTUNITY PROMULGATED BY THE TEXAS REAL ESTATE COMMISSION TREC of 8 4-28-2014 Page Address of Property NOTICE Not For Use Where Seller Owns Fee Simple Title To Land Beneath Unit RESIDENTIAL CONDOMINIUM CONTRACT RESALE 1. If Buyer purchases a residential service in an amount not exceeding. Buyer should review any residential...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your residential contract resale form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your residential contract resale form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing residential contract resale online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit condominium resale form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

How to fill out residential contract resale form

How to fill out a residential contract resale:

01

Start by gathering all the necessary information about the property being sold, such as the address, legal description, and any special features or conditions.

02

Identify the parties involved in the contract, including the seller(s) and buyer(s). Make sure to include their full legal names, contact information, and any other relevant details.

03

Specify the purchase price and the terms of payment, including the amount of the deposit, any financing arrangements, and the deadline for the closing.

04

Include any contingencies or conditions that need to be met before the sale can be finalized, such as the buyer obtaining financing or the seller making necessary repairs.

05

Describe any included or excluded items, such as appliances, fixtures, or furniture, and clarify whether they are part of the sale or not.

06

Include any disclosures or representations required by law, such as information about the property's condition, any known defects, or the existence of environmental hazards.

07

Specify the date and location of the closing, where all parties will meet to sign the necessary documents and transfer ownership of the property.

08

Attach any additional documents or addendums that are relevant to the transaction, such as inspection reports, appraisal documents, or HOA rules and regulations.

09

Review the completed contract carefully to ensure accuracy and clarity. Consider seeking legal advice or assistance if needed.

10

Once the contract is filled out correctly, all parties involved should review and sign it to indicate their agreement and commitment to the terms outlined.

Who needs a residential contract resale?

01

Homeowners who are selling their property and want to have a legally binding agreement with the buyer.

02

Real estate agents or brokers who assist in the sale of residential properties and want to ensure all necessary terms and conditions are documented.

03

Buyers who are purchasing a residential property and want to protect their interests by having a written contract that outlines the terms of the sale.

04

Lenders or financial institutions who may require a residential contract resale as part of the loan approval process.

05

Attorneys or legal professionals who handle real estate transactions and need to draft or review residential contract resale agreements.

Video instructions and help with filling out and completing residential contract resale

Instructions and Help about texas condominium contract form

Fill trec condominium resale : Try Risk Free

People Also Ask about residential contract resale

What is paragraph 6 of the one to four family residential contract?

Is under paragraph 16 mandatory mediation provides a lower cost and less formal way to resolve a dispute?

What is paragraph 15 of the TREC contract?

What is paragraph 23 of the one to four family residential contract?

What is paragraph 23 of TREC contract?

What is the purpose of paragraph 23 of the one to four family residential contract?

What is paragraph 21 of the 1 to 4 family residential contract?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file residential contract resale?

The seller of the residential property is usually responsible for filing the contract for resale. The buyer should also be aware of the process and make sure they are aware of the legal details involved in the transaction.

What is the penalty for the late filing of residential contract resale?

The penalty for the late filing of residential contract resale is a $200 fine per contract.

What is residential contract resale?

Residential contract resale refers to the process of selling a residential property that is still under contract with the original buyer. In this situation, the contract is transferred to a new buyer, typically through an assignment or assignment clause in the original contract. The new buyer would assume all the terms and conditions of the original contract, including any agreed-upon purchase price, contingencies, and closing dates. It is important to review the terms of the contract and consult with legal professionals to ensure compliance with all applicable laws and regulations.

How to fill out residential contract resale?

To fill out a residential contract resale, you will need to gather the necessary information and follow these steps:

1. Obtain a blank residential contract resale form: You can typically find these forms online through your local real estate association or by contacting a local real estate attorney.

2. Seller's information: Fill in the name, address, contact information, and any additional details about the seller(s).

3. Buyer's information: Fill in the name, address, contact information, and any additional details about the buyer(s).

4. Property details: Provide the complete address of the property being sold. Include details such as the number of bedrooms, bathrooms, square footage, and any other significant features of the property.

5. Purchase price: Specify the agreed-upon purchase price for the property in both numerical and written form. Make sure to indicate the currency.

6. Financing details: If the buyer is obtaining financing, include the amount they will be financing and any additional terms related to the financing.

7. Earnest money deposit: Specify the amount of the earnest money deposit (if applicable) and any terms for its return or forfeiture.

8. Contingencies: Outline any contingencies that need to be fulfilled before the sale can be finalized, such as a home inspection or mortgage approval. Include specific details and deadlines for each contingency.

9. Disclosures: Include any required disclosures about the property or its condition as mandated by local laws. This may include information about previous repairs, inspections, or any potential issues known to the seller.

10. Closing and possession date: Specify the agreed-upon closing and possession dates. This is the date when the buyer officially takes ownership of the property and may also include any specific terms related to the transfer of possession.

11. Signatures: Require all parties involved (seller, buyer, and any representatives) to sign and date the contract. This includes any additional witnesses that may be required by local laws.

12. Review and legal advice: It is recommended to review the completed contract resale form with a real estate attorney or seek professional advice to ensure compliance with local laws and regulations.

It is important to note that requirements may vary by jurisdiction, so consult the applicable laws and regulations specific to your location to ensure compliance.

What is the purpose of residential contract resale?

The purpose of residential contract resale is to transfer or sell an existing contractual agreement between a homeowner (or seller) and a buyer to another party. This can occur when the original buyer wants to get out of the contract before its expiration or transfer the ownership rights to someone else. The purpose may vary depending on the circumstances, but some common reasons for residential contract resale include:

1. Financial reasons: The original buyer may need to sell the property due to financial constraints, such as job loss, inability to afford mortgage payments, or to free up cash for other investments.

2. Change in personal circumstances: Life events like marriage, divorce, relocation, or retirement may necessitate the sale of a residential contract.

3. Investment opportunities: Some buyers may purchase residential contracts with the intention of reselling them for a profit. These buyers may identify properties with potential value appreciation or seek to cash in on the current market trends.

4. Avoiding penalties: In certain contractual agreements, there may be penalties or fees associated with breaking the contract early. Reselling the contract allows the original buyer to transfer the obligations to another party and possibly avoid these penalties.

5. Change in housing needs: The original buyer may find that their current residential contract no longer meets their housing needs, and they wish to sell it to acquire a different property or lease agreement that better suits their requirements.

Overall, the purpose of residential contract resale is typically to allow individuals to transfer or sell their existing contractual obligations to another party, providing them with more flexibility, financial options, or the ability to exit their contract early.

What information must be reported on residential contract resale?

The information that must be reported on a residential contract resale can vary depending on the jurisdiction and specific requirements. However, here are some common elements that are often required to be included in the report:

1. Seller's Information: The name, address, and contact details of the seller(s) of the residential property.

2. Buyer's Information: The name, address, and contact details of the buyer(s) purchasing the property.

3. Property Details: A detailed description of the residential property, including its address, size (in terms of square footage or other applicable measure), number of bedrooms and bathrooms, amenities, and any unique features or qualities.

4. Purchase Price: The agreed-upon purchase price of the property, including any contingencies or conditions related to the payment.

5. Property History and Condition: Any information about the property's history, such as previous sales, renovations or repairs, known issues, or relevant disclosures that might impact the buyer's decision.

6. Terms and Conditions: Clear details about the terms and conditions of the sale, including any contingencies, financing arrangements, closing date, and other relevant contractual provisions.

7. Transfer of Ownership: The method or process by which the ownership of the property will be transferred from the seller to the buyer, such as through a deed or title transfer.

8. Inspection and Appraisal: Information about any inspections, appraisals, or assessments that have been conducted on the property, including the results or findings that are relevant to the sale.

9. Disclosures: Any mandated disclosures required by local, state, or national regulations related to the sale of residential property. These may include information about lead-based paint, environmental hazards, property defects, homeowner's association (HOA) rules and fees, or other relevant factors.

10. Signatures and Date: The date of the contract signing and the signatures of all parties involved, including the seller(s), buyer(s), and any real estate agents or brokers representing them.

11. Additional Terms: Any additional terms or conditions agreed upon by the parties, such as contingencies, warranties, or other contractual provisions.

It's important to note that the specific requirements for reporting may vary based on the legal and regulatory framework of the country, state, or locality in which the residential contract resale is taking place. Therefore, it is advisable to consult with a real estate attorney or knowledgeable professional in your jurisdiction to ensure compliance with the necessary reporting requirements.

How do I edit residential contract resale online?

With pdfFiller, the editing process is straightforward. Open your condominium resale form in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for the texas condominium resale in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your trec residential contract resale in seconds.

How can I edit residential contract on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing trec condominium form, you need to install and log in to the app.

Fill out your residential contract resale form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Condominium Resale is not the form you're looking for?Search for another form here.

Keywords relevant to residential contract texas form

Related to trec condominium contract

If you believe that this page should be taken down, please follow our DMCA take down process

here

.